ParaFi Capital Invests $35 Million into Solana's Jupiter Protocol

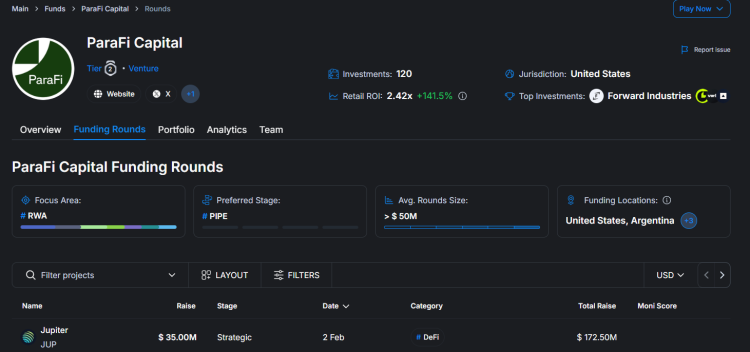

In a significant move for the Solana ecosystem, ParaFi Capital has announced a $35 million strategic investment in Jupiter, the leading decentralized exchange (DEX) aggregator on Solana. This marks the first time Jupiter has accepted external institutional capital after years of bootstrapped growth, highlighting growing confidence in Solana-based DeFi platforms amid a broader resurgence in onchain trading.

Jupiter, known for its l iquidity aggregation and trading tools, revealed the deal on February 2, 2026, with the transaction settled entirely in its native stablecoin, JupUSD, a dollar-pegged asset launched in January 2026 in partnership with Ethena Labs. The investment was structured as a market-priced token purchase of JUP, Jupiter's governance token, with no discounts and an extended lockup period for ParaFi, signaling long-term alignment. Additionally, ParaFi received warrants to acquire more tokens at higher prices, further tying their interests to Jupiter's future success.

The funding comes at a pivotal time for Jupiter, which has processed over $1 trillion in trading volume in the past year alone and expanded its offerings beyond simple swaps to include perpetual futures, lending protocols, and stablecoin services. Just days before the investment announcement, Jupiter integrated Polymarket's prediction markets directly onto its platform, allowing users to trade election outcomes, sports bets, and other events seamlessly on Solana without leaving the app. This move, in collaboration with Kalshi for a beta onchain prediction market launched in October 2025, positions Jupiter as a one-stop hub for diverse onchain financial activities.

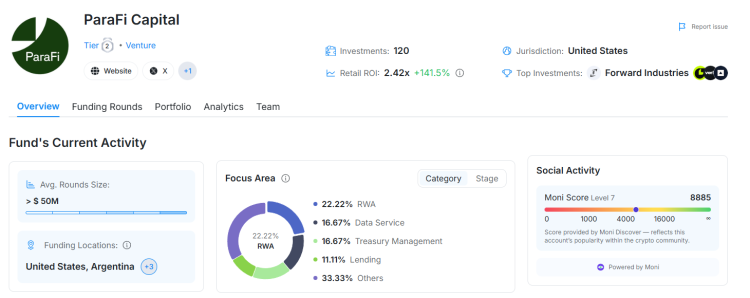

ParaFi Capital, a New York-based firm managing $2 billion in assets focused on digital ecosystems, described the investment as a commitment to deepening institutional participation in onchain finance. This aligns with a trend of venture firms like a16z Crypto pouring capital into Solana protocols through token deals, such as their $50 million investment in Jito in October 2025 and $15 million in Babylon in January 2026.

Market reaction was swift: JUP's price surged approximately 9% in the 24 hours following the news, reflecting investor optimism. On X, discussions highlighted the deal's implications for Solana's DeFi dominance, with users noting integrations like JLP Loans for amplified yields and global payment tools via Jupiter Global. One post emphasized the investment's role in liquidity optimization and payment infrastructure, underscoring Jupiter's push into multi-DEX routing and Solana-native innovations.

This investment not only bolsters Jupiter's resources for accelerating infrastructure development but also underscores Solana's appeal for high-volume, low-cost DeFi applications. As ParaFi locks in for the long haul, expect further expansions in areas like encrypted prediction markets via partners like Epoch and Arcium, potentially drawing more institutional flow to #SOL and #JUP. With over $3 trillion in lifetime trading volume, Jupiter is solidifying its position as a cornerstone of the Solana network, paving the way for broader adoption in 2026 and beyond.

3 free cases and a 5% bonus added to all cash deposits.

5 Free Cases, Daily FREE & Welcome Bonuses up to 35%

a free Gift Case

EGAMERSW - get 11% Deposit Bonus + Bonus Wheel free spin

EXTRA 10% DEPOSIT BONUS + free 2 spins

3 Free Cases + 100% up to 100 Coins on First Deposit

Comments