End of Bear Market in Crypto Approaching

The cryptocurrency market, which is going through tough times, may be approaching the end of its bear cycle. According to the latest report from Compass Point analysts, the current crypto bear market is in its "final innings," and Bitcoin (BTC) is likely to find a bottom in the $60,000–$68,000 range, assuming no broader U.S. stock market bear. Analysts Ed Engel and Michael Donovan emphasize strong support around $65,000 from long-term holders who acquired 7% of their BTC in that range.

However, according to experts, in the event of extreme negativity, such as issues in the S&P 500 stock market or the collapse of a major player, similar to the events with Luna and FTX in 2022 - Bitcoin could drop to $55,000. This would require a significant shock, akin to the 2022 stock bear market, when historical average costs were breached.

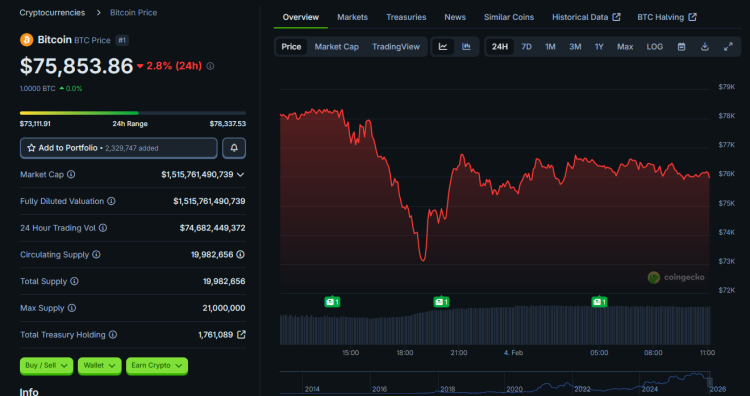

Currently, Bitcoin is trading around $76,000, down 2-3% over the past day. According to Yahoo Finance, the BTC price on February 4, 2026, is hovering near $76,131, after falling from recent highs. The market reflects pressure from ETF outflows: since January 15, $3 billion in net outflows have been recorded, with over 50% of ETF assets underwater. The recent drop to $74,532 matches the average cost basis for ETF investors.

Other analysts share the view of the approaching end of the bear market. According to Bitwise CIO Matt Hougan, crypto is in a "full-fledged crypto winter" since January 2025, but the market is closer to the end than the beginning. Historically, crypto winters last about 13 months, and the current cycle has already lasted over a year. Positive catalysts could include strong economic growth, passage of the Clarity Act, or nation-state Bitcoin adoption.

One of the key factors for overcoming the bear market could be the monetary policy of the U.S. Federal Reserve. The current federal funds rate is 3.5–3.75%, with an effective rate of 3.64% as of February 2026. In January, the Fed left the rate unchanged, but there is pressure to cut due to reckless fiscal policy: budget deficits in the U.S. and other G10 countries remain significantly wider than pre-COVID levels, pressuring bond yields. Analysts note that central banks face political pressure to lower rates to curb fiscal dominance.

The new Fed chair, nominated by President Donald Trump, is Kevin Warsh, a former Federal Reserve governor. His nomination is seen as a "hawkish surprise," and if confirmed, Warsh will begin his term in May 2026. Despite his hawkish reputation, a potential 1% rate cut (from the current 3.75%) could occur before the U.S. midterm elections in November 2026, scheduled for November 3. This could stimulate the crypto market, as lower rates traditionally favor risk assets.

While short-term risks remain tilted downward, analysts advise investors to prepare for potential recovery.

"We see very strong support in this range, and our base case assumes BTC will bottom near $65K," note Compass Point.

Other forecasts, such as from ChatGPT, see BTC in February in the $75,000–$90,000 range, while Claude is more cautious, forecasting $70,000–$85,000.

The crypto market continues to be volatile, but signals suggest that the "bear end" may be closer than it seems. Investors should monitor macroeconomic indicators and Fed decisions to determine the next move.

3 free cases and a 5% bonus added to all cash deposits.

5 Free Cases, Daily FREE & Welcome Bonuses up to 35%

a free Gift Case

EGAMERSW - get 11% Deposit Bonus + Bonus Wheel free spin

EXTRA 10% DEPOSIT BONUS + free 2 spins

3 Free Cases + 100% up to 100 Coins on First Deposit

Comments