Analysts Expect Significant Capital Inflows into Spot Bitcoin ETFs in 2026

According to Bloomberg senior analyst Eric Balchunas, the net inflow over the first two trading days of the year reached $1.2 billion, equivalent to an annual pace of $150 billion. This substantially exceeds the figures from 2025, when inflows amounted to around $22-27 billion amid a "rainy" market environment. Balchunas notes that if they can attract $22 billion when conditions are tough, the potential is exponential once the macroeconomic "sun shines."

Based on our data, the Bloomberg analyst anticipates inflows of $50-70 billion in 2026, contingent on Bitcoin rising to $130,000-140,000. Even in an unfavorable market, $22 billion is projected, with figures potentially much higher under improved conditions. This aligns with other forecasts: TokenInsight projects over $50 billion in net inflows, with AUM reaching $180-220 billion. Analysts at Bitwise also predict that ETFs will absorb more than 100% of new Bitcoin, Ethereum, and Solana issuance due to accelerating institutional demand.

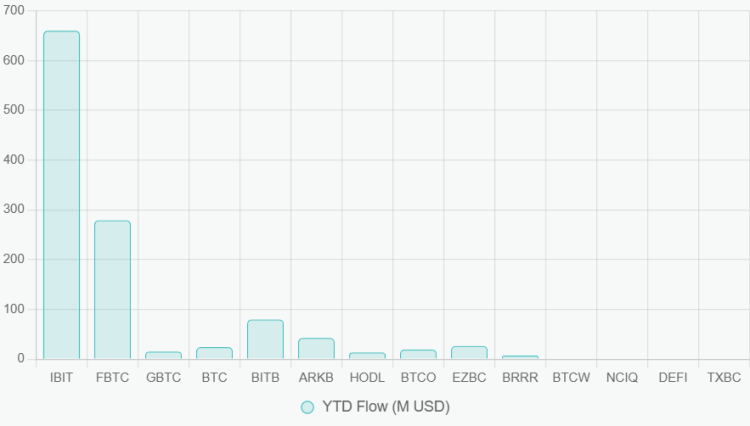

As of January 7, 2026, Bitcoin's price is hovering around $93,927, following a recent climb to $94,352 the previous day. This comes amid broad optimism: inflows exceeded $1.1 billion in the first two days, with $697 million on the second day alone—the largest single-day figure since October 2025. Institutional players like BlackRock (IBIT) and Fidelity (FBTC) are leading, with YTD inflows of $659.84 million and $279.27 million, respectively.

Here is the breakdown of YTD inflows for major ETFs (in million USD):

Total assets under management (AUM) have reached $117 billion, dominated by IBIT at $69.5 billion. This indicates a shift from retail hype to steady institutional accumulation. Additional factors, such as the Federal Reserve's $500 billion liquidity injection and potential approvals for new ETFs (e.g., from Morgan Stanley and Goldman Sachs), could propel Bitcoin to $200,000 in 2026.

Experts, including Crypto Patel, highlight the historical trend: over 101 weeks, the inflow-to-outflow ratio is 7.5:1, with net accumulation of $57.93 billion. Considering the supply reduction post-2024 halving and rising demand, 2026 promises to be a year of significant boom for Bitcoin and related instruments. Investors should monitor macroeconomic indicators, as they will directly influence inflow dynamics.

3 free cases and a 5% bonus added to all cash deposits.

5 Free Cases, Daily FREE & Welcome Bonuses up to 35%

a free Gift Case

EGAMERSW - get 11% Deposit Bonus + Bonus Wheel free spin

EXTRA 10% DEPOSIT BONUS + free 2 spins

3 Free Cases + 100% up to 100 Coins on First Deposit

Comments