Bitcoin Hashrate Drops 4%, Potentially Bullish Signal for Price

According to a report from investment firm VanEck, such "capitulation" among miners has historically been a bullish signal, often preceding BTC rallies. This is supported by data from Cointelegraph, where VanEck analysts note that since 2014, negative hashrate growth over 30 days has led to positive 90-day Bitcoin returns in 65% of cases.

Context of the Hashrate Decline

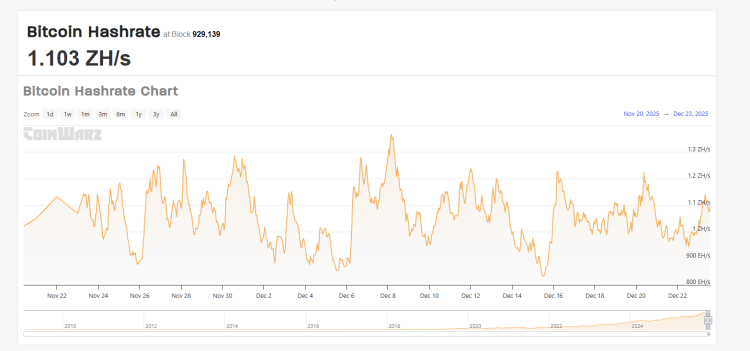

Bitcoin's hashrate, which reflects the network's computational power, decreased by 4% from mid-November to December 15, 2025 - the largest monthly drop since April 2024. VanEck analysts Matthew Sigel and Patrick Bush attribute this to the shutdown of about 1.3 GW of mining capacity in China, as well as overall stress among miners due to BTC price declines. At the time of writing, Bitcoin is trading around $88,400, which is 30% below its all-time high of $126,080 reached on October 6, 2025.

VanEck's historical data shows that prolonged periods of hashrate compression often correlate with better returns: negative 90-day hashrate growth has led to positive 180-day returns in 77% of cases, with an average increase of 72%. This is explained by weak miners exiting the market, reducing pressure on BTC supply, while stronger players continue to accumulate.

Additionally, the profitability threshold for miners has decreased: for the 2022 Bitmain S19 XP model, the break-even electricity price fell from $0.12 per kWh in December 2024 to $0.077 per kWh by mid-December 2025. This indicates that the market is "cleansing" itself of inefficient players.

Hashrate Stabilization

Based on our own research, as of December 22, 2025, Bitcoin's hashrate has slightly recovered. According to Hashrate Index data, the 7-day simple moving average (SMA) increased by 0.8% – from 1049 EH/s to 1057 EH/s. The 30-day SMA also points to stabilization around 1024-1027 EH/s. CoinWarz reports the current global hashrate at 1003 ZH/s (equivalent to ~1 ZH/s), with mining difficulty at 148.20 T at block height 929,051.

VanEck believes the current situation creates an attractive zone for long-term investors, as hashrate drops often occur closer to market bottoms than tops. CoinDesk confirms that such dynamics could signal a recovery in momentum for Bitcoin.

However, as always in crypto, this is not financial advice. The market remains unpredictable, and investors should conduct their own analysis.

3 free cases and a 5% bonus added to all cash deposits.

5 Free Cases, Daily FREE & Welcome Bonuses up to 35%

a free Gift Case

EGAMERSW - get 11% Deposit Bonus + Bonus Wheel free spin

EXTRA 10% DEPOSIT BONUS + free 2 spins

3 Free Cases + 100% up to 100 Coins on First Deposit

Comments