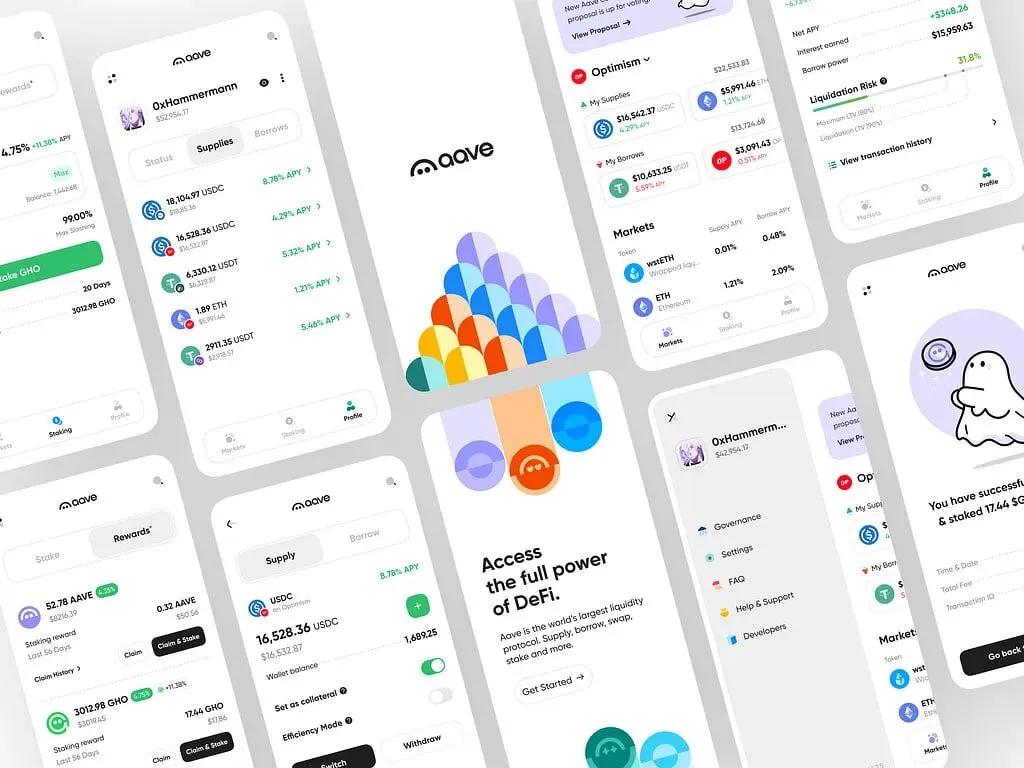

Aave Launches "Save and Earn" App in Apple Store

DeFi giant Aave is making a revolutionary step towards mass adoption by launching the mobile app " Aave: Save and Earn " in the Apple App Store. This tool is positioned as a "super-savings account" offering up to 10% annual percentage yield (APY) on savings, significantly outperforming traditional bank rates. The launch happened just four days ago and has already attracted the attention of investors and newcomers to the world of cryptocurrencies.

How Does the New Aave App Work?

The "Save and Earn" app is based on technology acquired by Aave through the acqui-hire of the Stable Finance team in October 2025. Users can easily deposit funds from a bank account, credit card, or crypto wallet, maintaining full control over their assets. It uses stablecoins for stable savings, offering high interest rates through peer-to-peer lending in the DeFi ecosystem. Additionally, Aave provides account protection up to $1 million, making it appealing for those seeking alternatives to bank deposits.

This launch is part of Aave's strategy to expand DeFi beyond crypto enthusiasts. The company, which has already surpassed $25 billion in active loans, is integrating simple tools for everyday use, making decentralized finance accessible on smartphones.

Comparison with Traditional Banks

In a world where traditional banks offer rates from 0.5% to 3% annually on savings accounts (depending on the country; for example, in Ukraine, the average deposit rate is around 8-10% for hryvnia but much lower for dollars), Aave promises up to 10% APY on stablecoins like USDC or USDT. This makes it a "super-savings account" where profits are generated through DeFi protocols rather than bank reserves.

Advantages for Beginners:

- Instead of fixed bank rates, Aave uses dynamic APY that can increase with demand for loans in the ecosystem.

- The interface is similar to banking apps - no need for deep blockchain knowledge. Fiat currency deposits simplify entry.

- Users retain control over their keys, avoiding bank fees for transfers or maintenance.

- Available in over 100 countries, including Ukraine, without geographic restrictions of banks.

Risks to Consider:

- While stablecoins are stable, the DeFi market can fluctuate due to smart contract hacks or market crashes. Aave has a solid reputation (since 2020), but past incidents in DeFi, like the Ronin Network hack, remind us of potential losses.

- In the EU and US, oversight of DeFi is tightening (e.g., MiCA regulation), which could affect accessibility. For Ukrainians - risks of taxing crypto profits.

- If something goes wrong (e.g., gas fees in Ethereum), users could lose funds. Aave recommends starting with small amounts and using built-in protection tools.

Experts, such as analysts from The Defiant, note that this app could accelerate the shift from traditional finance to DeFi but advise diversifying portfolios.

DeFi One Step Closer to the Masses

The launch of "Save and Earn" signals that DeFi is evolving from a niche tool to mainstream. With the acquisition of Stable Finance, Aave is not only expanding its ecosystem but also making high yields accessible to millions of iOS users. For beginners, this is a chance to start small, but with an understanding of the risks.

3 free cases and a 5% bonus added to all cash deposits.

5 Free Cases, Daily FREE & Welcome Bonuses up to 35%

a free Gift Case

EGAMERSW - get 11% Deposit Bonus + Bonus Wheel free spin

EXTRA 10% DEPOSIT BONUS + free 2 spins

3 Free Cases + 100% up to 100 Coins on First Deposit

Comments