Binance Demonstrates Resilience Amid Market Correction: Trading Volumes and Reserves at Record Levels

According to analysts from CryptoQuant and CoinGecko, Binance processes more than one-third of all BTC and ETH inflows to exchanges, reflecting strong trust from both retail traders and institutional players.

Even after a sharp $370 billion drop in total market capitalization in October, Binance’s daily trading volumes remain impressive. Spot volume stands at $25 billion out of the industry-wide $65 billion (nearly 38% market share), while futures volume reached $62 billion out of a global total of $170 billion - representing 36% of all derivatives trading. These figures underscore the platform’s resilience: in the last 24 hours alone, spot volume was recorded at $15.49 billion and futures volume at around $68 billion, despite an overall decline in market activity.

Another key indicator is capital inflows. Binance handles more than $15 billion in daily BTC and ETH deposits, surpassing competitors like Coinbase ($11 billion). Since the beginning of 2025, Bitcoin ETFs have attracted $14.8 billion in net inflows, with a significant portion flowing through Binance, while Ethereum ETFs added $3.5 billion per month in November–December. Glassnode analysts note that institutional investors, including BlackRock, actively use the exchange for basis trading, which helps stabilize prices during periods of volatility.

Particularly striking are Binance’s stablecoin reserves, which have hit a record $51.1 billion, including $27.98 billion in USDT alone. This is 59% higher than reserves held by all other centralized exchanges combined and signals substantial “dry powder” ready for future buying. From October to November, stablecoin inflows across the industry exceeded $89 billion, with a peak of $8.9 billion in a single 30-day period in November - the highest level this year. Historically, such reserve levels have preceded major Bitcoin rallies, as seen in January 2023 and March 2025 when BTC surged over 250%.

“In periods of uncertainty like the current correction - driven by geopolitical factors and Fed rate expectations - Binance acts as an anchor for the entire market. High volumes and reserves indicate readiness for a rapid recovery,” commented CryptoQuant analyst Darkfost.

Experts forecast that a potential Fed rate cut in December, combined with the Ethereum Fusaka upgrade activated on December 3, could trigger a sharp V-shaped recovery. Bitcoin has stabilized around $93,000, and ETF inflows ($58.5 million on December 2 alone) are already pushing the price higher. For Binance, this is further proof of dominance: with 280 million users and 41% of global spot volume, the platform remains the primary hub for both institutions and retail traders.

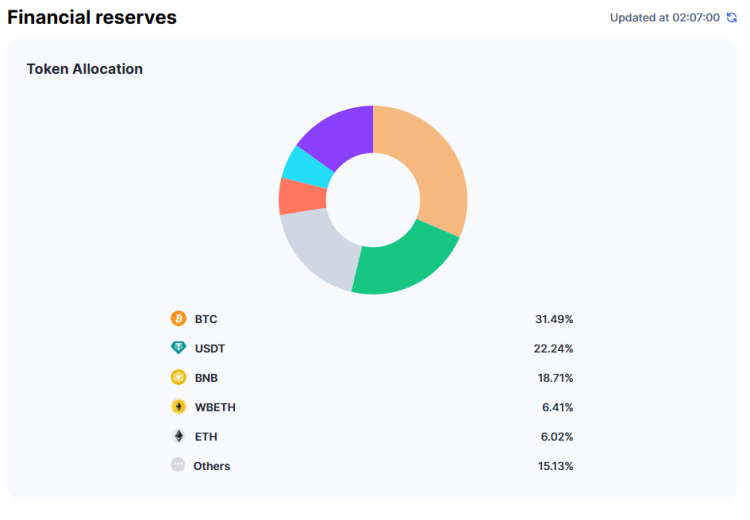

Binance continues to invest heavily in security and transparency: its latest Proof-of-Reserves report (April 2025) showed 105% coverage for BTC and 101% for USDT. Traders are advised to watch key levels, a breakout above $95,000 for Bitcoin could ignite a rally toward $120,000 by January 2026.

3 free cases and a 5% bonus added to all cash deposits.

5 Free Cases, Daily FREE & Welcome Bonuses up to 35%

a free Gift Case

EGAMERSW - get 11% Deposit Bonus + Bonus Wheel free spin

EXTRA 10% DEPOSIT BONUS + free 2 spins

3 Free Cases + 100% up to 100 Coins on First Deposit

Comments