Analysis of the XRP chart - the coin failed to break through $0.35 and will now decline

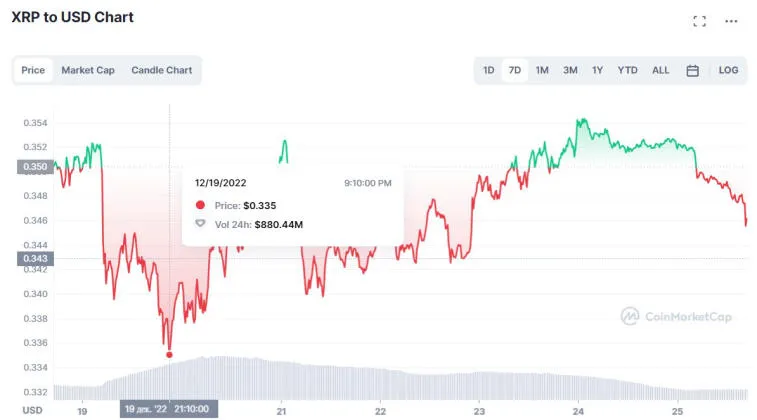

After Ripple (XRP), having found a local bottom in the form of $0.335 since December 19, went up and was able to add 7% in less than a week, the coin reached one of its key values.

The mark of $0.35 became a resistance level, in which an active struggle was waged between buyers and sellers. She had to determine in which direction XRP could continue to move. This time, the purchasing power was not enough to finally overcome $0.35.

On December 23, XRP crossed a key threshold of $0.35 and has been above that level until today. However, buyers failed to maintain the desired level and 12 hours ago, Ripple began to fall below the level they needed.

In such a short period of time, XRP managed to fall by 1% and so far is not going to show movements in the opposite direction.

In addition, although there was news recently that the US Securities and Exchange Commission, with which Ripple is fighting in court, although they showed weakness , this is still not enough to help pump XRP. The news may be good for Ripple lovers, but its power is still not as great as we would like.

As a result of the upcoming New Year holidays, due to which financial and cryptocurrency exchanges may suspend their activities, the crypto industry may enter a dead end for a while, and traders will be able to take a short break.

Earlier, we talked about the fact that the legal proceedings between the SEC and Ripple have moved forward. Representatives of the U.S. Securities and Exchange Commission have filed a motion with the court asking them to hide the documents of their former director of corporate finance from the public.

The XRP lawyer immediately said that such an action arouses a lot of suspicion, and if the SEC is asked to hide documents, then there really is something to hide and this, in theory, could help Ripple win the trial.

Proceedings between the parties to the conflict unleashed 2 years ago when the US Securities and Exchange Commission filed a lawsuit against Ripple, accusing the latter of conducting an ICO without prior registration.

The SEC has not yet developed any set of rules that companies associated with the cryptocurrency industry can adhere to. The US Securities and Exchange Commission believes that this is not necessary, since digital assets must comply with the same rules as securities.

Brad Garlinghouse, CEO of Ripple, said that Gary Gansler and his subordinates from the SEC do not want to do such work, as a result of which the rules and requirements are rather vague and incomprehensible.

Crypto enthusiasts are convinced that Ripple is in dire need of a victory over the SEC in a court case. In this case, the entire industry will benefit. If this does not happen, then the US will be able to tighten the rules for regulating cryptocurrencies, which will negatively affect the development of the industry. The final verdict in the case between Ripple and the US Securities and Exchange Commission will have to be delivered by Analisa Torres before May 31.

Comments